This is a more complex product than ordinary mortgages and lenders apply higher interest rates and charges than apply for normal home loans - generally, slightly more than 1% above standard mortgage variable rates. So, disregard marketing literature which trumpets this as a feature of any particular product, it is a legal requirement of all products. It's important to appreciate that in 2012 the Government introduced statutory 'negative equity protection' on all new reverse mortgage contracts - meaning that borrowers cannot end up owing the lender more than their home is worth. In this context and as a guide, you may expect to be able to borrow 15-20% of the value of your house at age 60 and and 1% more per year of age thereafter - so, a maximum of 25-30% at age 70 and 35-40% at age 80. Under the Responsible Lending principles of the National Consumer Credit Protection Act, qualifying applicants can borrow up to specified margins against the security of their primary residence.

The minimum borrowing age is typically 60, but differs depending on the lender, as does the maximum size of the loans, and the maximum loan to valuation ratio (LVR). Generally, the older you are the more you can borrow as a percentage of your property's value - and where there are joint borrowers the age of the youngest person determines eligibility. This can include the death of the owner(s), the last borrower leaving the property or breaches of particular clauses. You remain the owner of your house and may remain in it as long as you like, with no repayments required (interest compounds and adds to your loan balance), unless a trigger event occurs. The loan can be taken as a lump sum or a regular income stream, a line of credit or a combination of these options. What is a Reverse Mortgage?Ī reverse mortgage (RM) allows you to borrow money using the existing equity in your home as security. Much of this general discussion also applies to the Home Equity Access Scheme (HEAS), which should be considered as an alternative, although HEAS currently only provides access to an income stream, not a lump sums - although recent changes now allow access to small lump sums on an "advance payment" basis. The intention of this page is to provide existing and potential retirees with a general introduction to reverse mortgages, so that they can better have an informed debate with any adviser.

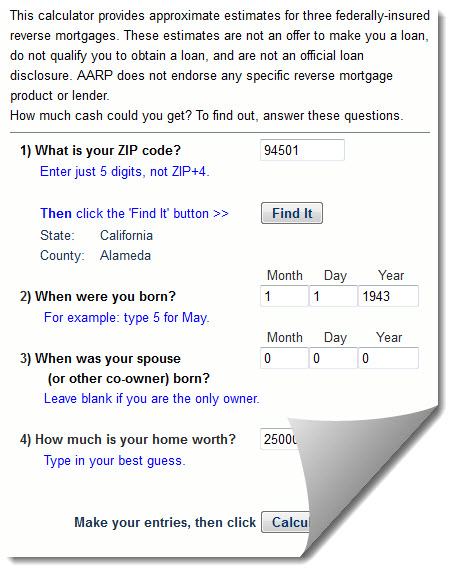

ALL REVERSE MORTGAGE CALCULATOR PROFESSIONAL

They certainly have a role to play in retiree finance but it it is vital that any retiree seek professional advice before making any commitment to a reverse mortgage. They suffer from clear reputational issues - having been miss-sold in the past - and a lack of awareness in the community.

Yet, like annuities to a lesser degree, they are a rarely used in Australia. In these circumstances, and also because of diminishing fixed interest returns, reverse mortgages can play an important role in providing retirees with safe access to an income stream. Often this means they own their own house but struggle to make ends meet and maintain a house that has often become far too large for their needs.

It is common to hear retirees described in Australia as being, "asset rich but cash poor". Refundable Accommodation Deposits - RADsĪn Introduction to Reverse Mortgages for Retirees.

0 kommentar(er)

0 kommentar(er)